Home Office Equipment Tax Exemption . This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. You may have supplied employees with office equipment so they could work from home. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. You do not have to pay tax on this as long as they. As a temporary concession, the government introduced. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus.

from www.uslegalforms.com

This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. You may have supplied employees with office equipment so they could work from home. As a temporary concession, the government introduced. You do not have to pay tax on this as long as they. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus.

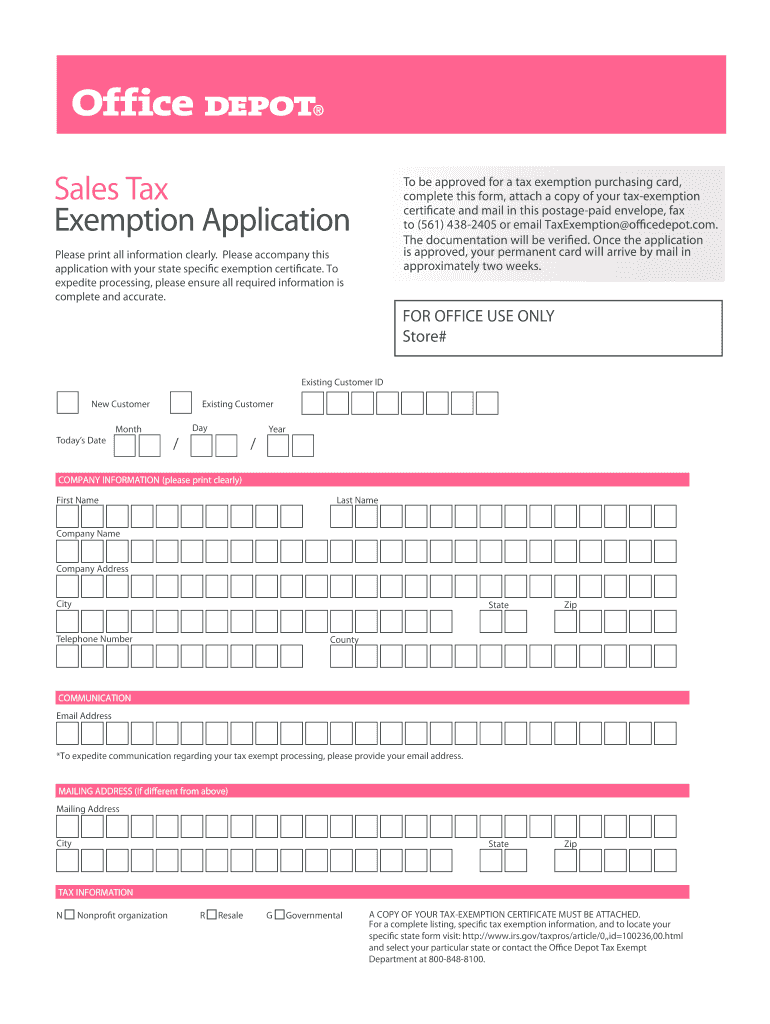

Office Depot Sales Tax Exemption Application Fill and Sign Printable

Home Office Equipment Tax Exemption Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. You do not have to pay tax on this as long as they. This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. As a temporary concession, the government introduced. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. You may have supplied employees with office equipment so they could work from home.

From pafpi.org

Certificate of TAX Exemption PAFPI Home Office Equipment Tax Exemption Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. You do not have to pay tax on this as long as they. As a temporary concession, the government introduced. You may have supplied employees with office equipment so they could work from home. This measure will create a temporary income tax and. Home Office Equipment Tax Exemption.

From epicofficefurniture.com.au

Can I Claim Office Furniture on My Taxes? What You Need to Know Home Office Equipment Tax Exemption You may have supplied employees with office equipment so they could work from home. This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. You do not have to pay tax on this as long as they. If you are required by your employer to work from home and the resulting home office. Home Office Equipment Tax Exemption.

From www.templateroller.com

Form R1376 Download Fillable PDF or Fill Online Governmental Employees Home Office Equipment Tax Exemption This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. You may have supplied employees with office equipment so they could work from home. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. You do not have to pay tax on this as long as. Home Office Equipment Tax Exemption.

From www.exemptform.com

HomeOwners Exemption Form Homeowner Property Tax San Diego County Home Office Equipment Tax Exemption If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. You may have supplied employees with office equipment so they could work from home. Certain equipment, services or supplies are taxable. Home Office Equipment Tax Exemption.

From classfullschmaltz.z19.web.core.windows.net

Request For Tax Exemption Letter Example Home Office Equipment Tax Exemption You may have supplied employees with office equipment so they could work from home. As a temporary concession, the government introduced. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. You do not have to pay tax on this as long as they. If you are required by your employer to work. Home Office Equipment Tax Exemption.

From www.exemptform.com

How To Get A Sales Tax Certificate Of Exemption In North Carolina Home Office Equipment Tax Exemption If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. As a temporary concession, the government introduced. This measure will create a temporary income tax and class 1 national insurance contributions. Home Office Equipment Tax Exemption.

From www.uslegalforms.com

Office Depot Sales Tax Exemption Application Fill and Sign Printable Home Office Equipment Tax Exemption This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. As a temporary concession, the government introduced. If you are required by your employer to work from home and the resulting home office expenses such as. Home Office Equipment Tax Exemption.

From www.countyforms.com

Cook County Tax Exemption Form 2022 Home Office Equipment Tax Exemption You may have supplied employees with office equipment so they could work from home. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. This measure will create a temporary income. Home Office Equipment Tax Exemption.

From www.exemptform.com

Sales Tax Exemption Form St5 Home Office Equipment Tax Exemption If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. You may have supplied employees with office equipment so they could work from home. You do not have to pay tax on this as long as they. Certain equipment, services or supplies are taxable if your employees are. Home Office Equipment Tax Exemption.

From hwfisher.co.uk

Covid19 Exemption for reimbursed home office equipment HW Fisher Home Office Equipment Tax Exemption You may have supplied employees with office equipment so they could work from home. You do not have to pay tax on this as long as they. This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. As a temporary concession, the government introduced. Certain equipment, services or supplies are taxable if your. Home Office Equipment Tax Exemption.

From www.exemptform.com

Cook County 2023 Long Time Homeowner Exemption Form Home Office Equipment Tax Exemption This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. You do not have to pay tax on this as long as they. You may have supplied employees with office equipment so they could work from home. As a temporary concession, the government introduced. If you are required by your employer to work. Home Office Equipment Tax Exemption.

From www.uktaxcalculators.co.uk

Employees Allowed TaxFree Reimbursement of Home Office Expenses UK Home Office Equipment Tax Exemption If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. You do not have to pay tax on this as long as they. This measure will create a temporary income tax. Home Office Equipment Tax Exemption.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF Home Office Equipment Tax Exemption You may have supplied employees with office equipment so they could work from home. This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. As a temporary concession, the government introduced. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. If you are required by. Home Office Equipment Tax Exemption.

From www.sanpatricioelectric.org

Tax Exempt Forms San Patricio Electric Cooperative Home Office Equipment Tax Exemption You may have supplied employees with office equipment so they could work from home. This measure will create a temporary income tax and class 1 national insurance contributions exemption for employer. As a temporary concession, the government introduced. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and.. Home Office Equipment Tax Exemption.

From www.pdffiller.com

Universal Tax Exempt Form Fill Online, Printable, Fillable, Blank Home Office Equipment Tax Exemption You do not have to pay tax on this as long as they. You may have supplied employees with office equipment so they could work from home. As a temporary concession, the government introduced. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. Certain equipment, services or. Home Office Equipment Tax Exemption.

From www.templateroller.com

New York City Senior Citizen Homeowners' Exemption Renewal Application Home Office Equipment Tax Exemption You may have supplied employees with office equipment so they could work from home. You do not have to pay tax on this as long as they. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. This measure will create a temporary income tax and class 1. Home Office Equipment Tax Exemption.

From www.pdffiller.com

Fillable Online sbr gov bc bc pst exemption form Fax Email Print Home Office Equipment Tax Exemption You may have supplied employees with office equipment so they could work from home. You do not have to pay tax on this as long as they. Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. As a temporary concession, the government introduced. This measure will create a temporary income tax and. Home Office Equipment Tax Exemption.

From www.formsbank.com

Top 21 Property Tax Exemption Form Templates free to download in PDF format Home Office Equipment Tax Exemption Certain equipment, services or supplies are taxable if your employees are working from home due to coronavirus. If you are required by your employer to work from home and the resulting home office expenses such as electricity charges and. As a temporary concession, the government introduced. You may have supplied employees with office equipment so they could work from home.. Home Office Equipment Tax Exemption.